Safety seems to be a lot on people’s minds lately, especially for investors.

With the failure of financial and investment firms in the United States, such as Lehman Brothers, Bernard L. Madoff Investment Securities, MF Global, and others due to fraud or, at best, questionable (or can we say “shady”) business practices, you can’t blame investors for worrying.

Investors and traders who use Forex (foreign exchange) as an asset class are no different. They have experienced their share of financial pain at the expense of fraudsters and corporate giants alike; so when it’s time to open a Forex account, they can’t help but wonder if their money is going to be there a year later.

“What happens to my account if my brokerage firm goes bankrupt?”

“Will my money still be there if I want to withdraw it?”

Questions like these are not only valid, but express the lingering thoughts in the minds of most FX participants nowadays. That is why it is so important that introducing brokers address these concerns and educate their clients about the safety of their money.

The NFA will protect me, right?

Throughout history, the US has been a symbol of financial stability. In the past, most international investors would blindly place their trust in the US financial system and allocate their money with the country’s banks and brokers.

Throughout history, the US has been a symbol of financial stability. In the past, most international investors would blindly place their trust in the US financial system and allocate their money with the country’s banks and brokers.

As we fast-forward to the present and stumble upon government shutdowns, sub-prime housing crises and QE-infinity fueled debt bubbles, even US Treasuries begin to look like instruments from the infamous Michael Milken’s junk bond inventory bible.

Despite the obvious signs of ultra-high risk in the American financial system, some naive currency traders are still clinging to a false sense of security that results from their misinterpretation of the level of safety afforded by the US regulatory bodies, such as the NFA and CFTC.

The CFTC (Commodity Futures Trading Commission), a governmental agency that regulates futures and futures options, and the self-regulated NFA (National Futures Association), the watchdog that is supposed to protect investors from fraud in commodities and futures, also oversee the FX business that takes place on US soil.

How much protection do these agencies really bestow on Forex account holders? An analysis of the recent failure of the previously mentioned MF Global, a major futures (and FX) brokerage firm with over $40 billion in assets, will show you just how much.

MF Global, formerly known as Man Financial, filed for Chapter 11 bankruptcy on October 31, 2011 due to a fiasco caused by $1.6 billion in missing customer funds inappropriately used to cover, in part, bad bets made by the firm’s CEO Jon Corzine on risky European bonds.

Missing customer money is bad, but what’s worst is that, by law, that money was supposed to be separated (known in industry circles as “segregated”) from the firm’s operational funds – so it shouldn’t have gone missing in the first place!

The Commodity Exchange Act (CEA), which was passed by the US government in 1936 and gave birth to the CFTC in 1974, clearly demands that futures brokers segregate client capital. “If this is the requirement,” you may be asking yourself, “why wasn’t it the case with MF Global?” Great question. The answer…inefficient regulation.

The NFA states, in the “Trading Futures, Options on Futures and Forex FAQs” section of their website, that even though brokerage firms are required to segregate customer funds, “customers still may not be able to recover the full amount of any funds in their account if the firm becomes insolvent and there are insufficient funds available to cover the obligations to all of its customers.”

So all that regulation is for what again?

If you think that the above NFA language sounds dire, just look at what the agency says about FX on page 15 of their “Trading Forex: What Investors Need to Know” publication. It goes, “In the event your dealer declares bankruptcy, any funds the dealer is holding for you in addition to any amounts owed to you resulting from trading, whether or not any assets are maintained in separate deposit accounts by the dealer, may be treated as an unsecured creditor’s claim.” An unsecured creditor has to get in line during a firm’s financial liquidation and hope that he’s lucky enough to recover pennies on the dollar of his original investment. Now doesn’t that make you feel warm and fuzzy inside?

Writer James B. Steward sums it up well in his New York Times article, “Trustee Sees Customers Trampled at MF Global,” published on June 8, 2012. In his comment about the report of James Giddens, MF Global’s court-appointed liquidation trustee, Stewart wrote, “More broadly, the report makes clear that the notion that customer assets are safely segregated…is an illusion…allowed by the Commodity Futures Trading Commission.”

Since 2008, when US Congress passed legislation to return authority over the Forex market in the United States to the CFTC to control fraud, regulators have been piling law after law on brokers working with US clients. Nevertheless, after witnessing multiple events like the MF Global fiasco involving large US companies where Forex customers have lost their shirts (REFCO in 2005, PFG Best in 2012, etc.), one has to wonder if all this legislation wasn’t just passed on the PRETEXT of protecting the public, while kicking the foreign exchange market to the curb. This should make you go, “Hmm?”

Don’t Rely on the Regulators – Focus on the Broker

The reality is that you cannot pass the baton to regulators, like the NFA and CFTC, to save your clients’ funds if the broker you work with pulls off an MF Global. As shown in the prior section, the law is not designed to help clients when it comes to foreign exchange.

“This is so depressing. I’m shutting my Forex business down!” If this thought just crossed your mind, then maybe we over did it. Our apologies. But don’t worry, the future is not so bleak (unless you’re an IB who caters to US clients; then you’re out of luck! Our prayers go out to you!).

As an IB, what you need to pay attention to is the broker. Yes, it is important that you do so. After all, if the firm you signed up with goes under and takes all your customers down with it, it’ll be extremely difficult for you to rebuild your referral network from scratch. To avoid the chances of this happening, you should only work with firms that provide adequate protection for their client assets, regardless of what their local regulators can or pretend they can do or not do. Even though most brokerage firms are not interested in going out of their way to protect any interests but their own, there are some that take extra steps to create an environment where safety truly abounds; that is, they make safety of funds one of their top priorities. What follows are some of the benefits firms that care about protection can offer.

Segregation – A Step in the Right Direction

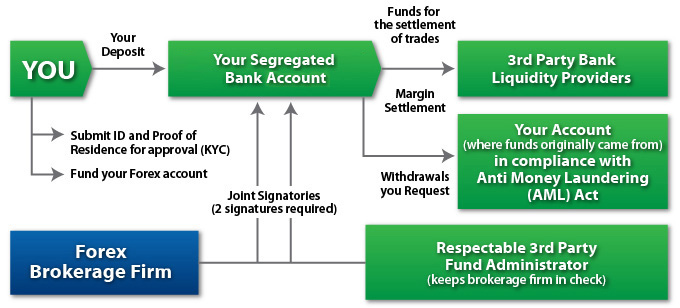

It all starts with the previously discussed topic of segregation. This is a must; in other words, at a bare minimum, the broker must truly keep client assets separated from the firms operational funds. No commingling of funds whatsoever is allowed. If a particular broker does not segregate, then you stay away from them. It’s that simple.

It all starts with the previously discussed topic of segregation. This is a must; in other words, at a bare minimum, the broker must truly keep client assets separated from the firms operational funds. No commingling of funds whatsoever is allowed. If a particular broker does not segregate, then you stay away from them. It’s that simple.

“But,” you may adamantly argue, “what good did segregation do to the Forex clients of MF Global?”

To that we say, “You have a good point,” and point you to the next section.

Third Party Administration – Keeping the Broker in Check

While segregation is important, it’s only as good as how well it is enforced. Even though MF Global was supposed to segregate, they didn’t and the regulators didn’t do much about it either until Corzine and his cronies had already tapped into the pool of customer funds long enough to practically empty it – all the way until the deep end.

The way shenanigans like these are avoided at the institutional fund level is through the use of a reputable third party administrator to monitor the flow of investor capital and act as a second signer (dual signatory) on all accounts. The role of the fund administrator is to protect the interests of all the investors by keeping the fund company in check. It is an essential role that adds an additional level of protection to the safety of funds equation.

Unfortunately, outside of the fund world, the use of a third party administrator is not common. It represents an added expense that most firms try to avoid, especially foreign exchange brokers. However, it can become an introducing broker’s best friend. If an IB works with broker that employs a third party administrator, it means that unless the brokerage firm receives the additional approval signature of the administrator, no funds can leave the client accounts. This basically makes the victimization of clients due to brokerage shutdowns as a result of either compliance issues or misappropriation of funds a highly unlikely event.

A visual representation of what happens to client deposits and withdrawals when a Forex broker with segregated accounts uses an independent third party administrator to oversee funds is provided below.

The combination of segregated customer accounts and third party administration provides a very secure environment for brokerage clients (read more in our maximum account safety section). As a result, the Forex IB who seeks to safeguard the money of their clients by working only with brokerage firms that implement these kind of protective measures will not only earn more of their clients trust, but also strongly position their referral business to achieve an unparalleled level of success.

If you think about it, isn’t that the most sensible approach in the unpredictable financial environment we all live in?